The cost of home repair is increasing, driven by a labour gap shortage, rising labour and materials costs, much of it the result of 39-year high inflation, which hit 8.1% in June.

As a result of the inflation, the Bank of Canada raised interest by an entire percentage point – the largest increase in nearly 25 years – to 2.5% in July. That institution has also expressed concerns that inflation increases would become entrenched in pricing.

Additionally, the Canadian housing marketing, including renovations, had risen to more than 8.5% of GDP during the pandemic, a high that hasn’t been matched in more than 25 years. With the Bank’s interest rate increase, it is expected that housing prices will fall by an estimated 24% over the next year – bad news for homeowners hoping to use their equity to fund home renovations and repairs.

In a survey, 27% of homeowners have used their home equity to borrow against their homes, and as interest rates rise, the cost of borrowing does as well, leaving a smaller amount for home repairs and renovations. Against that background, June saw a 1.9% drop in benchmark home prices, the biggest one-month drop in more than 15 years.

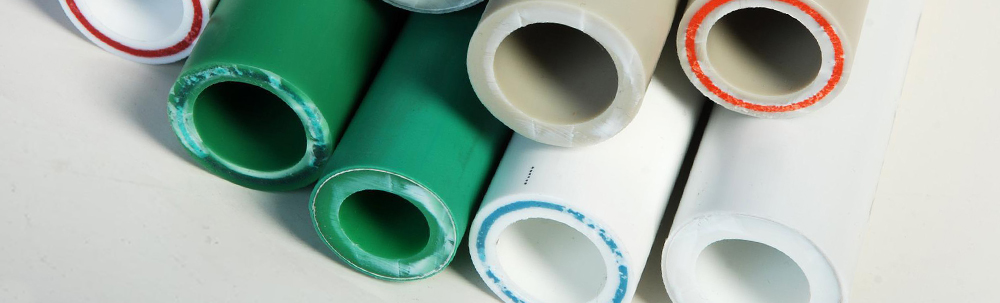

Among Canadian homeowners looking at renovations and repairs, 41% have said that they were going to put off their planned changes because of increasing costs, specifically of building materials, up from 35% percent in 2021. Construction costs in the first three months of 2022 increased 25% over 2021’s first quarter, according to Statistics Canada. Although not at the peak prices seen in mid-2021, prices have been creeping up since late 2021. For example, plastics such as pipes, have increased by more than one-third since early 2021, including a 4.4% jump in November 2021 alone.

Adding to the pressure of once again rising materials costs, supply chain issues have made some materials more expensive and difficult to obtain, leading contractors to both begin stockpiling and looking at more local sources of materials.

Even these aren’t the most difficult challenge facing the contracting industry – it’s the labour shortage, exacerbated by the pandemic, means that many contractors have as much work as they can handle at the moment, resulting in long wait time even for those who can afford the rising cost of renovations and repairs. Additionally, it’s expected that more than 700,000 skilled tradespeople will retire by 2028 and there will be a shortage of 10,000 tradespeople and 60,000 apprentices by 2025. There seems to be little appetite among Canadians to join the trades, as the Canadian Apprenticeship Found saw new registrations plumet by more than a third in 2020.

These conditions are putting a squeeze on homeowners, with three in five homeowners reporting they’ve had an unexpected home repair or upgrade over a year, with an out-of-pocket cost averaging more than $4,000. Additionally, two-in-five homeowners say inflation has kept them from doing home maintenance or making improvements. Spending on emergency repairs has skyrocketed by 42%, which is making keeping your home in good repair even more difficult than ever before.

A Service Line Warranties of Canada emergency home repair plan allows homeowners access to our network of pre-screened, licensed, and insured contractors. Plan holders don’t need to search for a contractor with availability and solicit bids for their repairs. They contact our North American operations centre, and we dispatch one of our network contractors who is local to them. Additionally, our optional warranties, protect homeowners from the unexpected – and rising – cost of emergency home repairs. Service Line Warranties pays contractors directly up to the benefit amount. There is no call out fees, deductibles or upfront costs to our plan holders.

To learn more about how you can secure this peace of mind for your community, contact us.